4 things to consider for a successful post-merger integration

How to ease the transition process and guarantee a smooth post-merger integration (PMI)

According to the Harvard Business Review, about 70 to 90 percent of all mergers and acquisitions are unsuccessful and therefore fail to deliver the expected results. The process of integration is complex and can be a daunting one that demands a lot of time and resources, diverting attention away from other issues of the business. Therefore, it is no wonder that “integration” is frequently cited by senior managers as one of their key challenges.[1]

This article describes four essential and often overlooked aspects that will ease the transition process and help guarantee a smooth post-merger integration (PMI) period.

1. Exploiting Synergies using Guideline Documents

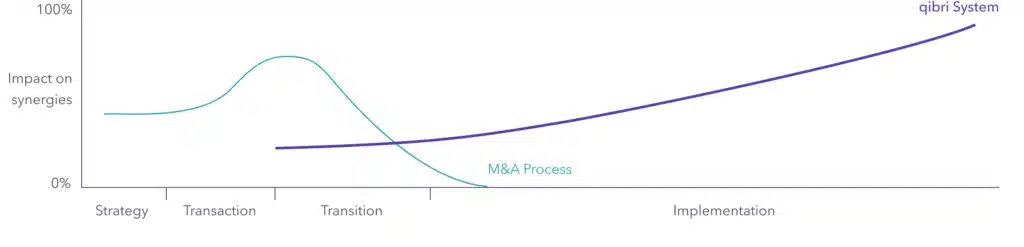

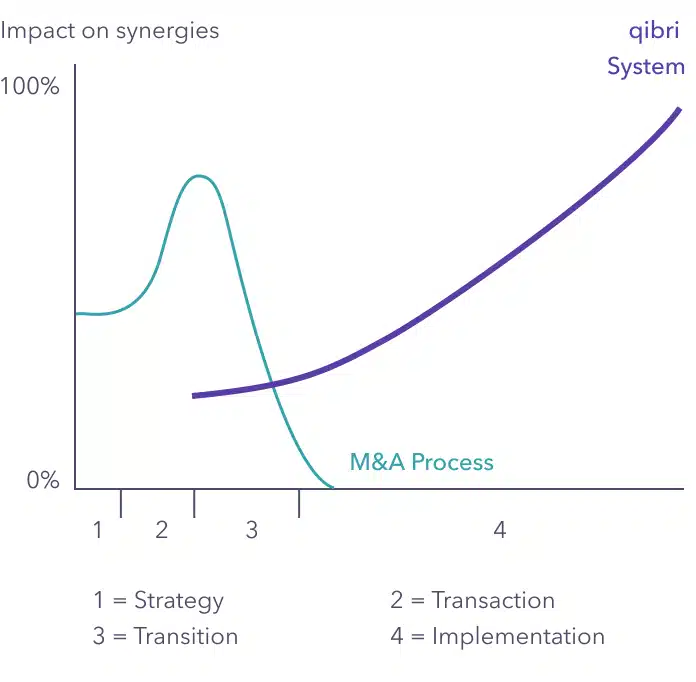

The target objective for mergers and acquisitions is to create added value that supersedes what the individual entities would be able to achieve on their own. This is realized through the exploitation of both combinational and transformational synergies.

Capturing full transformative potential requires substantial effort and the right enablers. This can be done by implementing a knowledge management platform, as it provides structured knowledge. Using this platform, employees can create and share guideline documents, which detail processes and practices within the company. Comparing and merging the information found in these documents allows organizations not only to identify overlapping activities, redundancies, and other inefficiencies but also to discover and leverage synergies and new opportunities for transformation.

2. Keeping your Employees’ Know-how on board

During the M&A process, there will be several employees who decide to leave the company and continue their professional careers elsewhere. This number can be up to 33% of the acquired workforce within the first year[2] This loss of key talent and personnel poses a big challenge for the organization, as outgoings take their knowledge and skills with them, and rebuilding it requires both time and resources. In addition, many firms fall victim to knowledge hoarding: Key players are reluctant to share their skills and information with others. In such an environment the loss of a crucial employee or even their temporary absence due to vacation or sickness can cause major inefficiencies and bring otherwise working processes to a grinding halt.

Having a working knowledge management platform enables and incentivizes employees to document and share their know-how with others, while simultaneously allowing them to access all the information they might need and to independently build new skills. Using a solution that simplifies the process and nudges knowledge-hoarders, knowledge-sharing can be improved significantly. This way, in the event of a key player leaving the company during the M&A period, their specific knowledge is not lost with them, but rather retained within the organization in the form of guideline documents and ready to be retrieved at any time.

3. Providing a solid base for the integration of IT landscapes

One key challenge during the PMI process is the consolidation of the IT landscapes of the two merging businesses. During mergers and acquisitions, consolidation of IT systems can be an important lever for capturing synergies and fueling digital transformation. Using the integration process as an opportunity to evaluate investment and implement transformative solutions can be crucial. Legacy systems are often incompatible and migrating data as well as transcribing documents in a unified taxonomy is cumbersome, making integration a very difficult and expensive procedure.

Investing in a common, user-friendly platform lays the foundation for merging IT systems. It reduces a significant amount of workload and eliminates the recurring problems and expenses that arise from integrating incompatible legacy systems, by comparing and discussing differences and similarities in semantics and architecture in a structured manner. This enables the company to quickly integrate and hit the ground running on day one, allowing executives to focus on other important issues.

4. Cultural Integration and Communication

Two separate entities with diverse backgrounds and histories coming together as one is often met with skepticism and resistance by the employees. It is therefore important to establish a common corporate culture and to strengthen the ties within the new organization. Research conducted by McKinsey[3] suggests that a merger where considerable focus is put on culture is about 3x as likely to be successful, which is supported by PWC [4], indicating that 93% of successful deal makers attested to having considered the cultural fit . However, full integration of culture is only obtained through a fusion of the policies and practices of both companies.

A company’s culture is codified within its practices and policies. By comparing guideline documents and semantics of the two organizations, similarities and differences can be uncovered and properly addressed. To get employees on board, it’s important to keep them informed and involved in the decision-making process, rather than making decisions in isolation without their input. Transparency is created by not only directly communicating policies and directives, but also by allowing for feedback on the guidance shared. This helps to promote a strong corporate culture, boosts morale, and aids in the retention of talent.

About the author:

Michael is the founder and CEO of qibri. He has over 20 years of experience in reducing complexity and decluttering organizations to boost productivity and fuel transformations.